Building a Diversified Portfolio: Best Practices

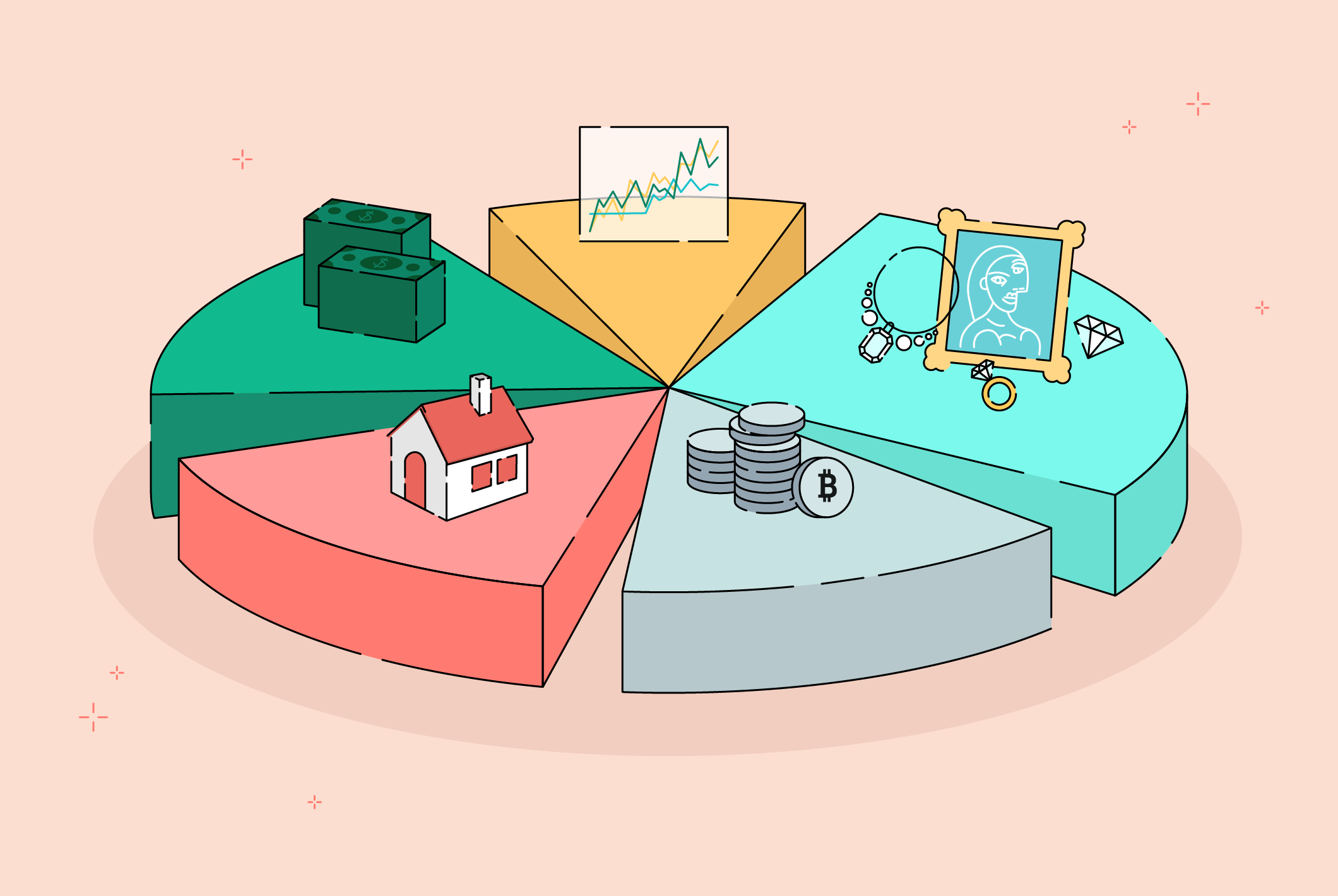

Asset Allocation: Allocate investments across different asset classes such as stocks, bonds, real estate, and commodities. Each asset class reacts differently to economic cycles and market conditions, reducing the overall risk of the portfolio.

Diversify Within Asset Classes: Within each asset class, diversify further. For stocks, consider investing in companies of different sizes (large-cap, mid-cap, small-cap), industries, and geographic regions. For bonds, diversify across issuers, durations, and credit qualities.

Consider Alternative Investments: Include alternative assets like real estate investment trusts (REITs), commodities (gold, silver), and hedge funds. These assets often have low correlation with traditional stocks and bonds, providing additional diversification benefits.

Geographic Diversification: Invest in assets across different geographic regions and economies. This helps mitigate country-specific risks and benefits from global economic growth trends.

Factor in Time Horizon and Risk Tolerance: Tailor the portfolio mix to align with your investment goals, time horizon, and risk tolerance. Younger investors with longer time horizons can afford to take more risks and may have a higher allocation to equities, while those nearing retirement may prefer a more conservative mix with greater allocation to bonds.